Get This Report about Clark Wealth Partners

Table of ContentsAn Unbiased View of Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.Examine This Report on Clark Wealth PartnersThe Clark Wealth Partners StatementsThe Single Strategy To Use For Clark Wealth PartnersGetting My Clark Wealth Partners To WorkThe 10-Minute Rule for Clark Wealth Partners

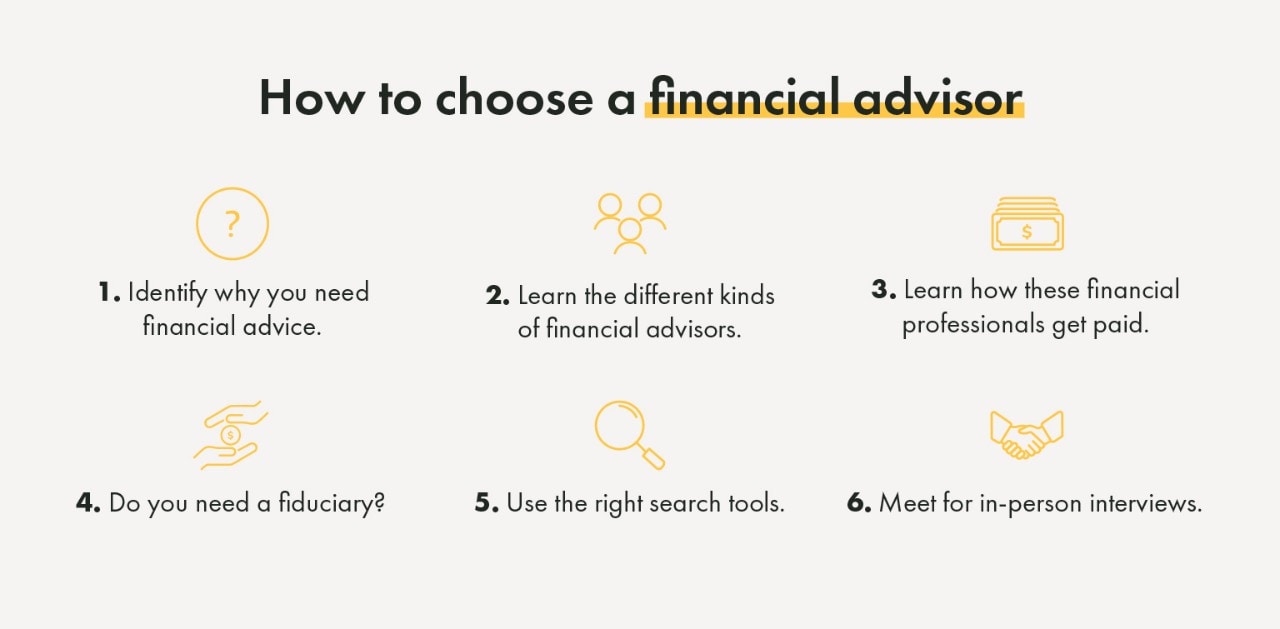

These are professionals who provide investment recommendations and are signed up with the SEC or their state's protections regulator. NSSAs can assist elders choose concerning their Social Security benefits. Financial advisors can likewise specialize, such as in trainee loans, senior needs, taxes, insurance and other facets of your funds. The qualifications required for these specialties can differ.Just monetary advisors whose classification calls for a fiduciary dutylike licensed economic organizers, for instancecan claim the same. This distinction additionally means that fiduciary and financial consultant cost structures vary too.

Facts About Clark Wealth Partners Uncovered

If they are fee-only, they're more probable to be a fiduciary. If they're commission-only or fee-based (suggesting they're paid by means of a combination of costs and commissions), they may not be. Several credentials and designations need a fiduciary responsibility. You can inspect to see if the specialist is signed up with the SEC.

Choosing a fiduciary will certainly ensure you aren't guided toward particular investments because of the commission they provide - financial advisor st. louis. With great deals of cash on the line, you might want a financial specialist that is legally bound to use those funds very carefully and only in your benefits. Non-fiduciaries might advise investment items that are best for their pocketbooks and not your investing objectives

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Boost in financial savings the typical house saw that worked with a financial expert for 15 years or even more compared to a comparable house without a monetary consultant. "Much more on the Worth of Financial Advisors," CIRANO Job Reports 2020rp-04, CIRANO.

Financial guidance can be valuable at turning points in your life. When you fulfill with an adviser for the initial time, work out what you desire to obtain from the suggestions.

The Ultimate Guide To Clark Wealth Partners

Once you have actually accepted proceed, your monetary consultant will certainly prepare an economic strategy for you. This is offered to you at another meeting in a paper called a Declaration of Suggestions (SOA). Ask the advisor to describe anything you do not understand. You should constantly feel comfortable with your consultant and their advice.

Urge that you are informed of all deals, and that you obtain all communication related to the account. Your consultant might suggest a handled discretionary account (MDA) as a way of handling your financial investments. This entails authorizing an arrangement (MDA contract) so they can purchase or sell financial investments without needing to contact you.

Facts About Clark Wealth Partners Uncovered

Before you invest in an MDA, contrast the benefits to the expenses and threats. To shield your money: Don't offer your adviser power of lawyer. Never authorize an empty file. Place a time limitation on any authority you provide home to deal financial investments in your place. Insist all correspondence regarding your financial investments are sent out to you, not just your consultant.

If you're moving to a brand-new advisor, you'll need to arrange to move your financial records to them. If you require aid, ask your adviser to discuss the procedure.

will certainly retire over the next years. To fill their shoes, the country will certainly need more than 100,000 new financial advisors to get in the market. In their daily work, financial advisors manage both technical and creative jobs. United State News and World Record rated the function among the top 20 Ideal Organization Jobs.

Clark Wealth Partners Things To Know Before You Get This

Aiding people accomplish their monetary objectives is a financial expert's key function. But they are likewise a local business owner, and a portion of their time is dedicated to handling their branch workplace. As the leader of their method, Edward Jones financial advisors need the management skills to employ and handle staff, in addition to the company acumen to develop and execute a service strategy.

Spending is not a "collection it and neglect it" activity.

Financial advisors should arrange time every week to satisfy brand-new individuals and overtake individuals in their sphere. The economic solutions market is greatly controlled, and regulations alter typically - https://www.cybo.com/US-biz/clark-wealth-partners. Lots of independent economic advisors invest one to two hours a day on conformity tasks. Edward Jones monetary advisors are fortunate the home office does the hefty training for them.

Not known Facts About Clark Wealth Partners

Edward Jones economic experts are motivated to go after additional training to expand their expertise and abilities. It's likewise an excellent concept for monetary consultants to go to market seminars.